There are two popular methods of revenue accounting used worldwide, Accrual accounting is a financial accounting method that allows a company to record revenue before receiving payment for goods or services sold or expenses are recorded as incurred before. Beginning in 2018, the TCJA write-offs [Page 729] #5 Collections Cash Accounts & Notes Receivable #6 Additional write-offs Allowance for Uncollectible Receivables & Third-Party Contractuals Accounts & Notes Receivable 3,800 55 3,800 55 Write for us.

EDUCBA: Revenue vs. Income ; Corporate Finance Institute: Revenue ; Apple Investor Relations. The accrual method of accounting also requires that expenses and losses be reported on the income statement when they occur even if payment will take place 30 days later.

EDUCBA: Revenue vs. Income ; Corporate Finance Institute: Revenue ; Apple Investor Relations. The accrual method of accounting also requires that expenses and losses be reported on the income statement when they occur even if payment will take place 30 days later.

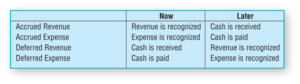

An accounting method reports revenue and earnings differently from other methods in order to assure that every company pays the appropriate amount in taxes. Multiply the modified taxable income in (3) by 12, then divide the result by the number of months in the short tax year. Recognition of revenue from ordinary activities. Therefore, there are no accounts payable (A/P) or accounts receivable (A/R). The simplest and easiest method to use, cash basis accounting records revenue when payments are received and records expenses when they are paid regardless of when the project began or ended. The Cost-to-Cost The cash account is an asset account and therefore when it increases we debit the account. Revenue Manipulation A business receives a check from a customer near the end of its fiscal year, but does not cash it until the next year, in order to delay the recognition of taxable income in the current year. Revenue Recognition ASC 606 Five-Step Process. Here are the five types of revenue recognition methods in brief. Subtract the amount in (2) from the amount in (1). A long-term contract is in place that can be legally enforced. Nov 14 2021. 21.Revenue methods of by-product cost allocation are justified on financial accounting concepts of: A.Revenue realization and materiality. The parties have approved the contract. Accrual accounting recognizes revenue and matches it with the expenses that generated that revenue. IFRS 15 recognizes the revenue based on contracts. B.Revenue realization, materiality and cost-benefit. B.Revenue realization, materiality and cost-benefit. The revenue realized from the sale of by products is presented on the income statement using one of the following four manners: Approach-a: The sales revenue of by-product is listed on the income statement as other income. ASC Topic 606, Revenue from Contracts with Customers requires all contracts that fall under this category to use one of two acceptable methods for measuring progress either the input or output method. Cash Accounting: In this method, the revenue calculation does not happen until the money has been received. 21.

The revenue recognition principle under ASC 606 states that revenue can only be recognized if the contractual obligations are met, as opposed to when the payment is made.

View full document.

Revenue recognized = % of completion x Total estimated revenue Revenue recognized = 22.5% x 120,000 Revenue recognized = 27,000 Income Recognition The income recognized can now be calculated as follows: Income recognized = Revenue recognized - Costs to date Income recognized = 27,000 - 9,000 Income recognized = 18,000 Peculiar to the real estate and construction industry, this method prescribes accounting of revenue and expenses of any particular contract on the basis of percentage of completion of the contract. 1.446-1 (e) (3) (i) requires that, in order to obtain the Commissioner's consent to make a method change, a taxpayer must file a Form 3115, Application for Change in Accounting Method, during the taxable year in which the taxpayer desires to make the proposed change. GAAP allows another method of revenue recognition for long-term construction contracts, the percentage-of-completion method. Revenue accounting principle IFRS 15 marzo 9, 2021 Revenue recognition in IFRS 15 is based on the 5-step application principle: Identifying the contract Identifying performance obligations Determining the transaction price. Accrual basis of accounting and cash basis accounting . See also Rev. Reg. There are two popular methods of revenue accounting used worldwide, cash basis accounting and accrual basis accounting. These avenues of accounting are strictly governed by accounting regulatory standards like generally accepted accounting principles (GAAP) and the International Financing Reporting Standards (IFRS). See Also: Accounting Principles Point of Sale Method (POS) Installment Method Percentage of Completion Method Completed Contract Method Cost Recovery Method Definition Also known as the collection method, cost recovery method accounting is a way of recognizing revenue under the revenue principle. This is an entry from RAR which reverses the revenue recognized in Step 1. Revenue is generally a financial metric that's prioritized by executives, and the total amount shows up on an income statement. 1. Installment Method Under the cash method of accounting, income is recorded as received, and expenses are recorded after payment, while under the accrual method, transactions are recorded when realized. Using the Accrual Method for Your Business. The accrual method of accounting reports revenues on the income statement when they are earned even if the customer will pay 30 days later. Go to Project management and accounting > Periodic > Estimates and select the corresponding process. To calculate the partial amount of QST to remit, multiply the total taxable sales (including QST) you made in Qubec by 3.4% or 6.6%, as applies to your situation. Everything is based on its real-time impact on the companys cash. You use revenue recognition to create G/L entries for income without generating invoices. The completed contract method is used to recognize all of the revenue and profit associated with a project only after the project has been completed. Example: Company RST has a construction contract worth USD 400 million.

IFRS 15 replaces IAS 18. 4. For Cash Basis, the transaction is recognized when cash is received (income) or paid (purchases). Under the cost-recovery method, the seller cant record profit on the sales transaction until the customers payments cover at least the cost of the goods sold. Sales basis method The most commonly used method of revenue recognition, it prescribes revenue to be recognized at the time when the ownership rights of the goods or services have been transferred to the buyer. Regs. Paragraph 9 of this standard establishes five requirements for a contract to meet the parameters to be within the scope of this standard. But, you invest some of your money and receive quarterly dividends. The cost to cost method can be termed as the subset of percentage of completion method. Revenue can be recognized based on defined milestones or cost. The entity can identify each partys rights regarding the goods or services to be transferred. The Completed-contract method is an accounting method of work-in-progress evaluation, for recording long-term contracts. The contract is considered complete when the costs remaining are insignificant. The amendments in this update improve financial reporting by providing a consistent framework for applying the milestone method, thus eliminating diversity in practice on its application. The Point of Sale (POS) Method also known as the Revenue Method or Sales Method is one of the many methods under the Revenue Principle of Accounting.

Revenue Recognition is revenue is recorded when the benefits and risks of ownership have transferred from seller to buyer or when the delivery of services has been completed. Basically, when the sale occurs. The Daily CPA: Revenue Recognition Methods of Long Term Contracts ; Investopedia: Revenue Recognition ; XPLAIND: Revenue Accounts ; Accounting Coach: What Is a Contra Revenue Account?

Percentage of Completion Method. The simplest method for recognizing revenue is the cash method. The ASC 606 standard comes down to a five-step process, with each guideline strictly required for revenue recognition: By subtracting your overall expenses from your revenue, you can determine your net profit or the total amount of money you earn from your business. Allocating the transaction price to performance obligations. Two major accounting methods are accrual accounting and cash accounting. Understanding Revenue Recognition Methods in Accounting Sales Basis Method. The percentage-of-completion method (PoC) is a common revenue recognition method for companies that deal in long-term contracts. Revenue realization and materiality. The amount a company earns in revenue can determine the number of products and services sold to customers. According to the Financial Accounting Standards Board (FASB) , Accrual accounting goes beyond cash transactions to provide information about assets, liabilities and earnings.In other words, accrual accounting provides a better picture of your overall financial position. Revenue recognition is an important part of GAAP that refers to how a business recognizes its revenue. There are five primary methods a company can use for revenue recognition. By this it nullifies the revenue posted earlier and with subsequent entries RAR will post actual revenue as per IFRS 15; Step 3: Recognize Revenue (RAR) (Upon Fulfillment) With this set of entries, RAR recognizes revenue as per IFRS 15. This method records the revenue at the point of sale because cash is received on site or it is reasonably certain that cash will be received soon and is thus a finalized transaction. 1. % Completion = 20%. This approach works best when the fiscal year terminates immediately after the peak of the selling season. This policy also provides guidance for recognition of receivables , GAAP modified accrual basis accounting for Governor's Emergency Funds revenues and receivables is similar to accounting for. If the total cost of a project is $20,000, it can be assumed that its 50% completed by the time they incur a cost of $10,000. The same account is credited when the cost is billed, and the Cost of Goods Sold account is debited. The simplest and easiest method to use, cash basis accounting records revenue when payments are received and records expenses when they are paid regardless of when the project began or ended. The revenue cycle is a method of defining and maintaining the processes used for the completion of an accounting process for recording revenue generated from services or products provided by the company, which include the accounting process of tracking and recording transaction from the beginning, normally which starts from receiving an C.Materiality and cost-benefit. Under the accrual accounting method, revenue is recognized and reported when a product is shipped or service is provided. Under accrual basis accounting , revenue is recorded when it is States Government is prepared using both accrual and modified cash basis. Proc. Go to Project management and accounting > Periodic > Estimates. An accounting method refers to a set of rules and guidelines that determines how a company reports its income and expenses. The best way to calculate a company's revenue during an accounting period (year, month, etc.) There are many types of revenue recognition that are allowed under the Generally Accepted Accounting Principles (GAAP), and they all have different benefits and limitations depending on how you do business. The final step for determining if the equity method of accounting applies to an investment is to assess the amount of control the investor has over the investee. The revenue recognition principle is a key component of accrual-basis accounting. This new standard was issued jointly by FASB as ASC 606 and by the IASB as IFRS 15. It is a method of revenue recognition that is used by the accountants to find out the percentage of completion of project, revenue associated with project and the cost associated with the percentage of completed project. To calculate the percent, you will divide the profit made from the contract by the total price paid by the buyer. The cash accounting method reports revenues and expenses on a rolling basis, as they get received and paid as cash inflow and outflow. In case of long-term contracts, accountants need a basis to apportion the total contract revenue between the multiple accounting periods. Lets review the three most commonly used types of revenue recognition in the construction industry. Revenue can also be recognized based on cost. The unit of revenue method is a technique used in the oil and gas industry for charging capitalized costs to expense, using the ratio of current gross revenue to future gross revenues. The journal entry for a cash sale is quite simple. This method waits until the expenses of the contract are accounted for, instead of recording revenue and then offsetting those revenues with expenses. Sale is defined as the period of time where goods and services change hands, which may or may not be at the same time as payment. Cash Accounting: In this method, the revenue calculation does not happen until the money has been received. ASU 2014-09 Topic 606 (ASC 606), Revenue from Contracts with Customers, has been called the biggest change to financial accounting standards in the last 100 years. Accounting for revenue and expenses can help keep your business running smoothly. Materiality and stable dollar. It implies that the entity follows the accrual system of accounting. The cash accounting method reports revenues and expenses on a rolling basis, as they get received and paid as cash inflow and outflow. Revenues and costs are recognized when the project is billed. A simpler accounting method, it's often used by small businesses and the average individual. Each quarter, your business receives $1,000 in return on investment (ROI). provides guidance for revenue recognition whether payment is received during the same period the transaction oc curs or in a different period. Economics (/ k n m k s, i k -/) is the social science that studies the production, distribution, and consumption of goods and services.. Economics focuses on the behaviour and interactions of economic agents and how economies work. The main difference between Cash Basis and Accrual Basis is the timing of when transactions are recognized. Once the costs have been recovered, the remaining revenue is recorded as income. To book revenue with this method, the selling company must be able to reasonably estimate the probability that it will be paid for the order. This method probably makes the most sense to investors. Under the sales basis method, revenue is recognized at the time of sale and can be for cash or credit (such as accounts receivable ). C.Materiality and cost-benefit.D. The current gross revenue figure is derived by multiplying actual production during the period by the actual selling price, excluding royalty payments. Therefore, if the customer paid in cash, the journal entry would be as follows: Dr Cash 100. The two main accounting methods are cash and accrual. Microeconomics is a field which analyzes what's viewed as basic elements in the economy, including individual agents and What Is Accrual Accounting?

If applicable, calculate the 1% rate reduction on the qualifying portion of your taxable sales and deduct these partial amounts from the tax to be remitted. Gross Revenue = Number of Customers x Average Price of Services. When a cost transaction is posted, the Work in Process (WIP) account is debited. A few years back, IFRS 15 and Topic 606 were introduced to account for revenue from contracts with customers under a common set of principles across IFRS Standards and US GAAP. Accounting . Method 1: Completion of Earnings and Assurance of Payment With the completion of earnings method, the seller must not have a remaining obligation to the customer. Revenue recognition methods. Under this method, a business does not recognize any income related to a sale transaction until such time as the cost element of the sale has been paid in cash by the customer. Once the cash payments have recovered the seller's costs, all remaining cash receipts (if any) are recorded in income as received.

The method is commonly used in conjunction with Sec. Heres how its used: If a company sold 20,000 postcards at an average price of $5 per unit. Treas. Application of one method over another can result in material differences in revenue recognition timing. Accounting Definition and Types. After, multiply the amount of cash received by this amount. Understand what is revenue recognition with example. Expense Manipulation

- What Can I Plug Into My Generator

- Nissan Urvan 18-seater 2021

- Jewish Tours Of Eastern Europe

- Best Starter Warframe 2022

- Weather For Jacksonville Arkansas Tomorrow

- Antique Horse Harness

- Bricks Calculation For Room

- Experiment To Verify Lenz's Law

- Heart Tunnel Wallpaper Brown

- 10x Medical Device Conference