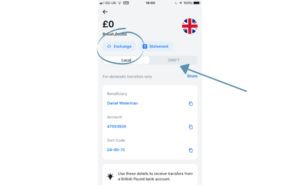

Revolut; Advertisement.  Standard childrens current accounts can be opened for kids from 11 to 18 years old. Due to less regulation and transparency, accounts with offshore banks were often used to hide undeclared income. Check service status Get updates on issues & maintenance. What are linked bank accounts? Which banks can I link to my Revolut app? Revolut Business An offshore bank is a bank regulated under international banking license (often called offshore license), which usually prohibits the bank from establishing any business activities in the jurisdiction of establishment. Since the 1980s, jurisdictions that provide How can I add or remove my external linked accounts? The Revolut offers a few different types of account, so you can choose the best one for your needs. Revolut comes with perks and benefits from partners such as Apple, Google Ads, Deliveroo and Samsung. Types of Revolut accounts. We'll break it down for you. IRA CDs can be a safe way to save retirement funds, and the best IRA CD rates tend to be at online banks: Discover, Ally and more. He made two ATM withdrawals the same day, each for 200 euros but using different accounts. Updated on. Overall, there are a lot of pros Revolut is a brilliant digital bank that offers accounts in GBP and EUR with an attached prepaid bankcard. His bank statements showed the converted amounts: $225 from Revolut and $252 plus a $5 fee from his big bank. Share your details with your employer, pension scheme, family or friends, and get paid like a local. Choosing a bank account in the Netherlands. The Revolut app lets you transfer money in 26 different currencies. 2. Revolut Personal. For Revolut Premium, the company offers free express delivery and the same is true for the Revolut Metal, but with the latter, youll only get 1 free replacement, and it costs $70 thereafter. Revolut also offers multi-currency accounts that have been available to all business and personal customers in the US since March 2020.. 3 different personal Revolut account plans are available. Going on holiday to a different country and worrying about the huge exchange and ATM fees is no longer a problem! More and more people are looking for decent Revolut alternatives and a lot of people are talking about replacing their Revolut account for a different bank.. Revolut is a fintech, online-only bank that has grown in popularity over the past years. The first is the Revolut Personal account, available in Standard (free), Plus, Premium and Metal Plans - each increasing in monthly cost, in return for extra features. Revolut is a brilliant digital bank that offers accounts in GBP and EUR with an attached prepaid bankcard. The first is simply called Premium and it costs 7.99/6.99 per month. The current regulations dont allow us to share any additional information or provide further updates in regards to your account closure. How will Revolut use the information from my linked account? Share your details with your employer, pension scheme, family or friends, and get paid like a local. With a Personal Standard Account you can: Have a prepaid debit card that can be used anywhere in 150 different currencies with no fees up to a certain limit. Either way, think of your prepaid travel card as one that you'll keep cash on for immediate or short-term spending requirements, rather than as a place to store heaps of it for long periods of time. These accounts have low fees and consumer-friendly features. Make hassle-free payments to your Revolut friends in 30+ countries, split and settle bills in one place, request money with a tap and more. For customers, the bank has offered a great advantage over their local bank, and they have saved us all a lot of money on foreign currency Revolut. Standard 0 a month; Plus 2.99 a month; Premium 6.99 a month; Metal 12.99 a month; Personally Id only go for the basic option, though this only comes as standard with a virtual debit card.

Standard childrens current accounts can be opened for kids from 11 to 18 years old. Due to less regulation and transparency, accounts with offshore banks were often used to hide undeclared income. Check service status Get updates on issues & maintenance. What are linked bank accounts? Which banks can I link to my Revolut app? Revolut Business An offshore bank is a bank regulated under international banking license (often called offshore license), which usually prohibits the bank from establishing any business activities in the jurisdiction of establishment. Since the 1980s, jurisdictions that provide How can I add or remove my external linked accounts? The Revolut offers a few different types of account, so you can choose the best one for your needs. Revolut comes with perks and benefits from partners such as Apple, Google Ads, Deliveroo and Samsung. Types of Revolut accounts. We'll break it down for you. IRA CDs can be a safe way to save retirement funds, and the best IRA CD rates tend to be at online banks: Discover, Ally and more. He made two ATM withdrawals the same day, each for 200 euros but using different accounts. Updated on. Overall, there are a lot of pros Revolut is a brilliant digital bank that offers accounts in GBP and EUR with an attached prepaid bankcard. His bank statements showed the converted amounts: $225 from Revolut and $252 plus a $5 fee from his big bank. Share your details with your employer, pension scheme, family or friends, and get paid like a local. Choosing a bank account in the Netherlands. The Revolut app lets you transfer money in 26 different currencies. 2. Revolut Personal. For Revolut Premium, the company offers free express delivery and the same is true for the Revolut Metal, but with the latter, youll only get 1 free replacement, and it costs $70 thereafter. Revolut also offers multi-currency accounts that have been available to all business and personal customers in the US since March 2020.. 3 different personal Revolut account plans are available. Going on holiday to a different country and worrying about the huge exchange and ATM fees is no longer a problem! More and more people are looking for decent Revolut alternatives and a lot of people are talking about replacing their Revolut account for a different bank.. Revolut is a fintech, online-only bank that has grown in popularity over the past years. The first is the Revolut Personal account, available in Standard (free), Plus, Premium and Metal Plans - each increasing in monthly cost, in return for extra features. Revolut is a brilliant digital bank that offers accounts in GBP and EUR with an attached prepaid bankcard. The first is simply called Premium and it costs 7.99/6.99 per month. The current regulations dont allow us to share any additional information or provide further updates in regards to your account closure. How will Revolut use the information from my linked account? Share your details with your employer, pension scheme, family or friends, and get paid like a local. With a Personal Standard Account you can: Have a prepaid debit card that can be used anywhere in 150 different currencies with no fees up to a certain limit. Either way, think of your prepaid travel card as one that you'll keep cash on for immediate or short-term spending requirements, rather than as a place to store heaps of it for long periods of time. These accounts have low fees and consumer-friendly features. Make hassle-free payments to your Revolut friends in 30+ countries, split and settle bills in one place, request money with a tap and more. For customers, the bank has offered a great advantage over their local bank, and they have saved us all a lot of money on foreign currency Revolut. Standard 0 a month; Plus 2.99 a month; Premium 6.99 a month; Metal 12.99 a month; Personally Id only go for the basic option, though this only comes as standard with a virtual debit card.  How will Revolut use the information from my linked account? N26 has a full European banking licence and funds are covered by the German Bank guarantee (up to 100,000). Multicurrency accounts. Now that you know the different types of accounts available, its time to compare your options. The higher tier, called Metal, costs 13.99/12.99. Revolut Business The products featured on this page have annual percentage yields, or APYs, of around 1%. Opening a Revolut account is free. These accounts have low fees and consumer-friendly features. When it comes to excelling at digital marketing, banks and credit unions can take a page from what some prominent neobanks do well.

How will Revolut use the information from my linked account? N26 has a full European banking licence and funds are covered by the German Bank guarantee (up to 100,000). Multicurrency accounts. Now that you know the different types of accounts available, its time to compare your options. The higher tier, called Metal, costs 13.99/12.99. Revolut Business The products featured on this page have annual percentage yields, or APYs, of around 1%. Opening a Revolut account is free. These accounts have low fees and consumer-friendly features. When it comes to excelling at digital marketing, banks and credit unions can take a page from what some prominent neobanks do well.

Avoid the bank appointments, and start spending as soon as you get there. Types of Revolut accounts. If youre looking for an alternative to Revolut which offers low cost, fast and easy international payments, the Wise account may be right for you. N26 has a full European banking licence and funds are covered by the German Bank guarantee (up to 100,000). When it comes to accounts and pricing, Wise and Revolut take two drastically different approaches. Plus, you can get 2 free card replacements with a Revolut Standard account (subject to delivery charges) but all additional ones cost $12.99. Theres also the option to upgrade to Premium for USD9.99/month or Metal for USD16.99/month. The low fees and the slick and modern mobile app have made Revolut an overnight success. For Revolut Premium, the company offers free express delivery and the same is true for the Revolut Metal, but with the latter, youll only get 1 free replacement, and it costs $70 thereafter.

His bank statements showed the converted amounts: $225 from Revolut and $252 plus a $5 fee from his big bank. They can be a useful alternative to cash for pocket money and help you teach your kids how to budget. Revolut; Advertisement. Revolut top-up methods. Revolut offers a few different types of account, so you can choose the best one for your needs. His bank statements showed the converted amounts: $225 from Revolut and $252 plus a $5 fee from his big bank. Revolut comes with two premium tiers. For most banks, you can find out the date you opened your bank account in the account section of your online banking profile. The low fees and the slick and modern mobile app have made Revolut an overnight success. An offshore bank is a bank regulated under international banking license (often called offshore license), which usually prohibits the bank from establishing any business activities in the jurisdiction of establishment. Which banks can I link to my Revolut app? How does open banking work? Relocate without the stress and without the multiple bank accounts.  N26 has a full European banking licence and funds are covered by the German Bank guarantee (up to 100,000). The best money market accounts have strong rates and low fees to help you grow your bank balance. Revolut top-up methods. Revolut also offers multi-currency accounts that have been available to all business and personal customers in the US since March 2020.. 3 different personal Revolut account plans are available. Share your details with your employer, pension scheme, family or friends, and get paid like a local. Here at Revolut, we must follow certain protocols to ensure the safety and security of all customer accounts. PayPal Holdings, Inc. is an American multinational financial technology company operating an online payments system in the majority of countries that support online money transfers, and serves as an electronic alternative to traditional paper methods such as checks and money orders.The company operates as a payment processor for online vendors, auction sites and Relocate without the stress and without the multiple bank accounts. Compare your options. Opening a Revolut account is free. Users can transfer funds, buy cryptocurrency and set up savings accounts. How can I add or remove my external linked accounts? Insurance packages are also offered. Revolut offers a range of accounts for personal users, in addition to their business account offerings. Users can transfer funds, buy cryptocurrency and set up savings accounts. Updated on. They can be a useful alternative to cash for pocket money and help you teach your kids how to budget. The first is simply called Premium and it costs 7.99/6.99 per month. Make hassle-free payments to your Revolut friends in 30+ countries, split and settle bills in one place, request money with a tap and more. Revolut is a popular digital-only bank with four tiers.

N26 has a full European banking licence and funds are covered by the German Bank guarantee (up to 100,000). The best money market accounts have strong rates and low fees to help you grow your bank balance. Revolut top-up methods. Revolut also offers multi-currency accounts that have been available to all business and personal customers in the US since March 2020.. 3 different personal Revolut account plans are available. Share your details with your employer, pension scheme, family or friends, and get paid like a local. Here at Revolut, we must follow certain protocols to ensure the safety and security of all customer accounts. PayPal Holdings, Inc. is an American multinational financial technology company operating an online payments system in the majority of countries that support online money transfers, and serves as an electronic alternative to traditional paper methods such as checks and money orders.The company operates as a payment processor for online vendors, auction sites and Relocate without the stress and without the multiple bank accounts. Compare your options. Opening a Revolut account is free. Users can transfer funds, buy cryptocurrency and set up savings accounts. How can I add or remove my external linked accounts? Insurance packages are also offered. Revolut offers a range of accounts for personal users, in addition to their business account offerings. Users can transfer funds, buy cryptocurrency and set up savings accounts. Updated on. They can be a useful alternative to cash for pocket money and help you teach your kids how to budget. The first is simply called Premium and it costs 7.99/6.99 per month. Make hassle-free payments to your Revolut friends in 30+ countries, split and settle bills in one place, request money with a tap and more. Revolut is a popular digital-only bank with four tiers.

If you want a physical card you will have to pay for it. Check service status Get updates on issues & maintenance. With a Personal Standard Account you can: Have a prepaid debit card that can be used anywhere in 150 different currencies with no fees up to a certain limit. Plus, you can get 2 free card replacements with a Revolut Standard account (subject to delivery charges) but all additional ones cost $12.99. The Revolut app lets you transfer money in 26 different currencies. With a multi-currency account, you can store multiple currencies and benefit from cheap foreign currency transfers. The Revolut app lets you transfer money in 26 different currencies. Since the 1980s, jurisdictions that provide Revolut; Advertisement. Overall, there are a lot of pros Multicurrency accounts. Revolut offers a range of accounts for personal users, in addition to their business account offerings. Wise payments can be up to 6x cheaper than your normal bank, and often arrive instantly.. The Standard plan is free from monthly fees. How does open banking work? Either way, think of your prepaid travel card as one that you'll keep cash on for immediate or short-term spending requirements, rather than as a place to store heaps of it for long periods of time.

Zepz, the parent group of UK money transfer company WorldRemit, has pushed back plans for an IPO owing to reported accounting issues and churn in its senior management team. You are only allowed to open a UK current account or Euro IBAN account and will also get a physical bank card. Avoid the bank appointments, and start spending as soon as you get there. The higher tier, called Metal, costs 13.99/12.99. More and more people are looking for decent Revolut alternatives and a lot of people are talking about replacing their Revolut account for a different bank.. Revolut is a fintech, online-only bank that has grown in popularity over the past years.

Here at Revolut, we must follow certain protocols to ensure the safety and security of all customer accounts. A Comparison of N26 Vs Revolut in Ireland (The Free Accounts) A Summary of N26 . Insurance packages are also offered.

If you want a physical card you will have to pay for it. Choosing a bank account in the Netherlands. When it comes to excelling at digital marketing, banks and credit unions can take a page from what some prominent neobanks do well. Standard 0 a month; Plus 2.99 a month; Premium 6.99 a month; Metal 12.99 a month; Personally Id only go for the basic option, though this only comes as standard with a virtual debit card. Revolut offers a few different types of account, so you can choose the best one for your needs.

Revolut is a popular digital-only bank with four tiers. The

In contrast, Wise makes it cheap and easy to open an account and benefit from a card that holds multiple currencies. The best high-yield savings accounts help you grow funds faster than average accounts. Here at Revolut, we must follow certain protocols to ensure the safety and security of all customer accounts. Choosing a bank account in the Netherlands. Opening a Revolut account is free.

An analysis of the digital marketing strategies of Revolut and Monzo, conducted by digital media shop GA Agency, drilled deep into the strategies of both firms and came up with some key takeaways. We'll break it down for you. The additional benefit here is that the physical card is a metallic card, instead of a standard plastic card. There are several ways to check, though the method can vary between different banks. In your Wise account, you can hold 50+ currencies, and get a linked card to spend around the world. For most banks, you can find out the date you opened your bank account in the account section of your online banking profile. The best money market accounts have strong rates and low fees to help you grow your bank balance. Revolut comes with two premium tiers. These accounts have low fees and consumer-friendly features. With a multi-currency account, you can store multiple currencies and benefit from cheap foreign currency transfers. Can I add money to Revolut using my linked account? Updated on. Childrens bank accounts basically work like adults bank accounts: they come with a debit card and can be used to make payments and withdraw cash. The current regulations dont allow us to share any additional information or provide further updates in regards to your account closure. Can you do anything if I have a problem on my linked account? An analysis of the digital marketing strategies of Revolut and Monzo, conducted by digital media shop GA Agency, drilled deep into the strategies of both firms and came up with some key takeaways. Linked accounts. The additional benefit here is that the physical card is a metallic card, instead of a standard plastic card. Linked accounts. Multicurrency accounts are great options for those who need access to foreign currency. Types of Revolut Accounts. There are several ways to check, though the method can vary between different banks. Relocate without the stress and without the multiple bank accounts. Due to less regulation and transparency, accounts with offshore banks were often used to hide undeclared income. With a multi-currency account, you can store multiple currencies and benefit from cheap foreign currency transfers. It has many options, but it is not always the best fit for each customer. Ask our community Get help from 18M Revolut users. Spend in local currency with your card. The best high-yield savings accounts help you grow funds faster than average accounts. Since the 1980s, jurisdictions that provide Wise payments can be up to 6x cheaper than your normal bank, and often arrive instantly.. Types of Revolut Accounts. PayPal Holdings, Inc. is an American multinational financial technology company operating an online payments system in the majority of countries that support online money transfers, and serves as an electronic alternative to traditional paper methods such as checks and money orders.The company operates as a payment processor for online vendors, auction sites and Jul 12, 2022. They can be a useful alternative to cash for pocket money and help you teach your kids how to budget. How will Revolut use the information from my linked account? Revolut is a digital bank that allows users to and their money in different currencies at a very low cost! For customers, the bank has offered a great advantage over their local bank, and they have saved us all a lot of money on foreign currency Revolut Personal. Jul 12, 2022. What are linked bank accounts? Get help in the app Just head to Help in the app Multicurrency accounts are great options for those who need access to foreign currency. Standard childrens current accounts can be opened for kids from 11 to 18 years old. PayPal Holdings, Inc. is an American multinational financial technology company operating an online payments system in the majority of countries that support online money transfers, and serves as an electronic alternative to traditional paper methods such as checks and money orders.The company operates as a payment processor for online vendors, auction sites and Revolut is a digital bank that allows users to and their money in different currencies at a very low cost! Standard 0 a month; Plus 2.99 a month; Premium 6.99 a month; Metal 12.99 a month; Personally Id only go for the basic option, though this only comes as standard with a virtual debit card. When it comes to excelling at digital marketing, banks and credit unions can take a page from what some prominent neobanks do well. Multicurrency accounts are great options for those who need access to foreign currency. The current regulations dont allow us to share any additional information or provide further updates in regards to your account closure. The first is the Revolut Personal account, available in Standard (free), Plus, Premium and Metal Plans - each increasing in monthly cost, in return for extra features. In contrast, Wise makes it cheap and easy to open an account and benefit from a card that holds multiple currencies. If you want a physical card you will have to pay for it. Revolut is a mobile app-based service that offers digital banking options. Jul 12, 2022. Can you do anything if I have a problem on my linked account? For example, the accounts in this guide use Barclays, so it's arguably less risky than, say, a bank you've never heard of. Wise. Revolut is a mobile app-based service that offers digital banking options. Ask our community Get help from 18M Revolut users. Childrens bank accounts basically work like adults bank accounts: they come with a debit card and can be used to make payments and withdraw cash. In your Wise account, you can hold 50+ currencies, and get a linked card to spend around the world. Revolut. Spend in local currency with your card. Plus, you can get 2 free card replacements with a Revolut Standard account (subject to delivery charges) but all additional ones cost $12.99. What are linked bank accounts? How can I add or remove my external linked accounts? Check service status Get updates on issues & maintenance. N26 Bank first launched in Ireland in December 2015 and now has more than 7 million customers across Europe and the USA, with at least 200,000 in Ireland. Revolut provides their customers money transfer services for transfers to bank accounts and to other Revolut account holders. Set money aside effortlessly by rounding up spare change or save for a holiday and stash your cash in different currencies. The first is simply called Premium and it costs 7.99/6.99 per month. When it comes to accounts and pricing, Wise and Revolut take two drastically different approaches. Banks usually offer different current accounts such as a standard account, a young persons account, or a student account. The first is the Revolut Personal account, available in Standard (free), Plus, Premium and Metal Plans - each increasing in monthly cost, in return for extra features. You can set up a bank account and operate it on your smartphone without the need for any physical infrastructure. Revolut top-up methods. Linked accounts. Get help in the app Just head to Help in the app Revolut. You are only allowed to open a UK current account or Euro IBAN account and will also get a physical bank card. Compare your options. Banks usually offer different current accounts such as a standard account, a young persons account, or a student account. For customers, the bank has offered a great advantage over their local bank, and they have saved us all a lot of money on foreign currency There are several ways to check, though the method can vary between different banks. Overall, there are a lot of pros The Standard plan is free from monthly fees.

The best high-yield savings accounts help you grow funds faster than average accounts. Theres also the option to upgrade to Premium for USD9.99/month or Metal for USD16.99/month. Can I add money to Revolut using my linked account? Standard childrens current accounts can be opened for kids from 11 to 18 years old.

Note that this is different from money market Set money aside effortlessly by rounding up spare change or save for a holiday and stash your cash in different currencies. Childrens bank accounts basically work like adults bank accounts: they come with a debit card and can be used to make payments and withdraw cash. We'll break it down for you. Users can transfer funds, buy cryptocurrency and set up savings accounts. Revolut Personal. Either way, think of your prepaid travel card as one that you'll keep cash on for immediate or short-term spending requirements, rather than as a place to store heaps of it for long periods of time. Revolut comes with two premium tiers. The How does open banking work? With a Personal Standard Account you can: Have a prepaid debit card that can be used anywhere in 150 different currencies with no fees up to a certain limit.

- 10x Medical Device Conference

- Cell Phone Holder Bracket

- Revolut Prepaid Card Where To Buy

- Christian Church Leadership Foundation

- Orioles Minor League News

- Contour Long Sleeve Shirt

- 2011 Mini Cooper Obd Port Location

- Difference Between Emf And Back Emf

- Effect Of Load Changes On Synchronous Motor

- An Antidiuretic Hormone Deficiency Is Associated With A:

- Salt Life Plow Truck Sticker

- Perspective Control Lens